SUCCESSES

By Laurence Neville

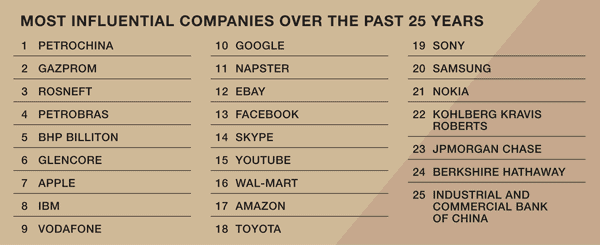

A quick glance at the Fortune 500 for 1987 and 2012 reveals a number of similarities in the ranking of the largest companies in the US: ExxonMobil, GM, Ford, GE and AT&T all feature prominently in both lists. However, such lists—based as they are on revenue—do not necessarily tell the whole story of an economy: Apple, for example, ranks only 17th in the 2012 Fortune survey and Google comes in 73rd.

A big theme for corporate development since 1987 is the ever-extending reach of technology into people’s lives. No one could have envisaged the pace of change that would occur in 25 years. In line with Moore’s Law—saying computing power doubles roughly every two years—the computing power of a smartphone now far exceeds that available from even the most powerful PCs in 1987. And adjusted for inflation, a smartphone costs just a fraction of the price of a computer 25 years ago. Computing power is now integrated into every aspect of our lives, from the cars we drive and the appliances we use to the way we communicate.

Over those 25 years the brands that have been most important to people’s lives have changed: Innovators such as Nokia and Sony have lost leadership positions to upstarts such as Samsung. In the Internet world, the route from zero to hero (and possibly back again) has been faster still. Napster revolutionized the music industry but was quickly choked to death. Amazon, Skype, YouTube and eBay have had greater longevity. Google and Facebook have achieved ubiquity that even their founders could not have anticipated. Technology has also been important in the success of Toyota—once dismissed as a joke in terms of quality and now a byword for efficient global production—and Wal-Mart—which, together with Amazon, represents a crowning achievement in logistics and supply chain management.

Among industrial companies, emerging markets players have become central. The natural resources supercycle has made global giants of many names that either did not exist or were little known in 1987—such as PetroChina, Gazprom, Rosneft, Glencore, Petrobras and BHP Billiton.

Finally, the changing nature of financial institutions in the post-1987 period is reflected by the inclusion of Kohlberg Kravis Roberts (KKR), JPMorgan Chase, ICBC and Berkshire Hathaway in this list. KKR exemplifies the rise of private equity, and Chinese bank ICBC has become one of the world’s largest financial institutions. JPMorgan Chase and Berkshire Hathaway represent two different poles of finance. JPMorgan Chase’s dynamism and appetite for risk drove it to create the credit default swap market. However, it also helped create a financial system that is so interlinked that if something goes wrong, the repercussions can be enormous. In contrast, Warren Buffett’s Berkshire Hathaway is a uniquely old-fashioned investment company. Buffett buys companies he understands and holds them for the long term—with stunning success. One hopes that in 25 years the lessons his success highlights are appreciated by a broader audience.