Panama’s environmental protests are winding down, but road blockages continue to cause losses of $200 million a day. Ongoing droughts are further reducing the number of ships allowed to use the Panama Canal daily to 24, down from 32 in August. The country’s reputation as a logistics and investment hub is in danger.

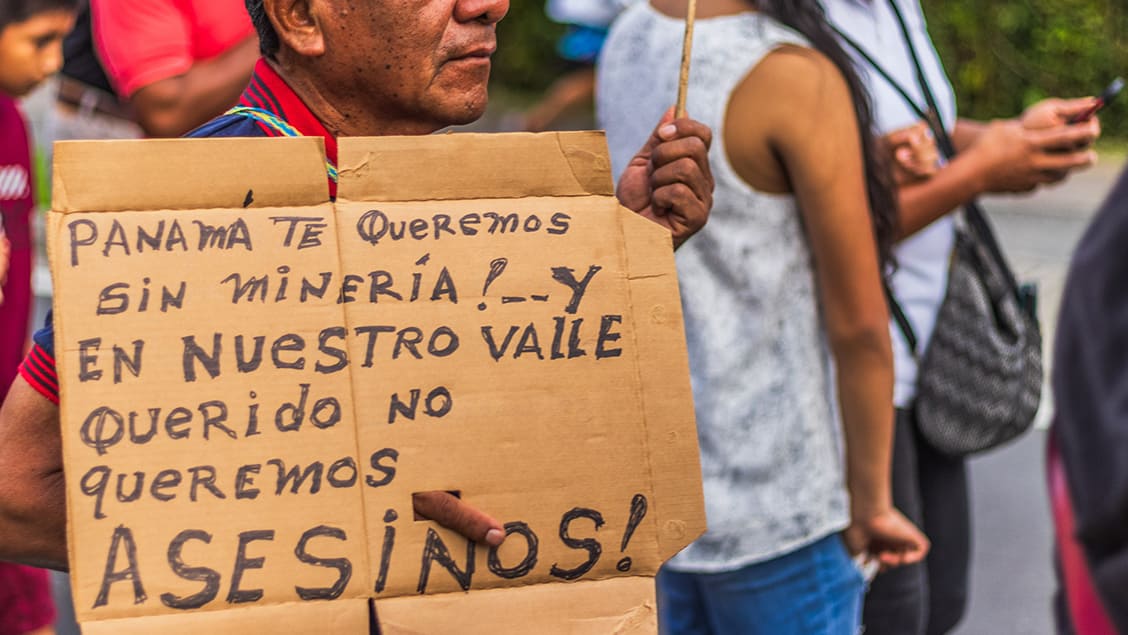

The signing of a contract between the government and Minera Panamá prompted a nationwide strike. Protesters say the deal violated national sovereignty and endangered regional biodiversity.

Panama’s Supreme Court had declared the contract unconstitutional, with the mine reducing output in the face of riots and blockages of its port facilities. Canadian owner First Quantum may be forced to take Panama to international arbitration. Experts suggest this could cost the country $20 billion.

Retail associations predict up to $8 million in losses a day, with $200 million in total over the first 30 days of the strike. Logistics losses alone are estimated to be $4.6 billion and rising. Coupled with drought, international businesses are either paying record amounts to move up the shipping queue or being forced to take longer routes.

With thousands of trucks stuck on Panama’s borders, the backlog is likely to affect global supply chains still recovering from pandemic-induced shocks.

Hugo Torrijos, president of the Panama Logistics Business Council, says, “Our future depends on our ability to facilitate the transit of global merchandise … we are talking about more than half of Panamanian families.”

Panama is experiencing shortages in food, fuel and medicines in some cities, with the government importing supplies from neighboring Costa Rica.

Although there are positive signs, such as universities readying to return, United Airlines has suspended flights to Panama due to “civil disturbances.”

Panama’s Banking Association in a statement added, “The riots have affected the attractiveness of Panama as a quality destination for foreign investment.”

According to the Economic Commission for Latin America and the Caribbean, Panama was one of only three Latin American countries—the others being El Salvador and Honduras—to see positive FDI in 2023. S&P Global revised its outlook to negative from stable. Other ratings agencies are taking a wait-and-see approach.