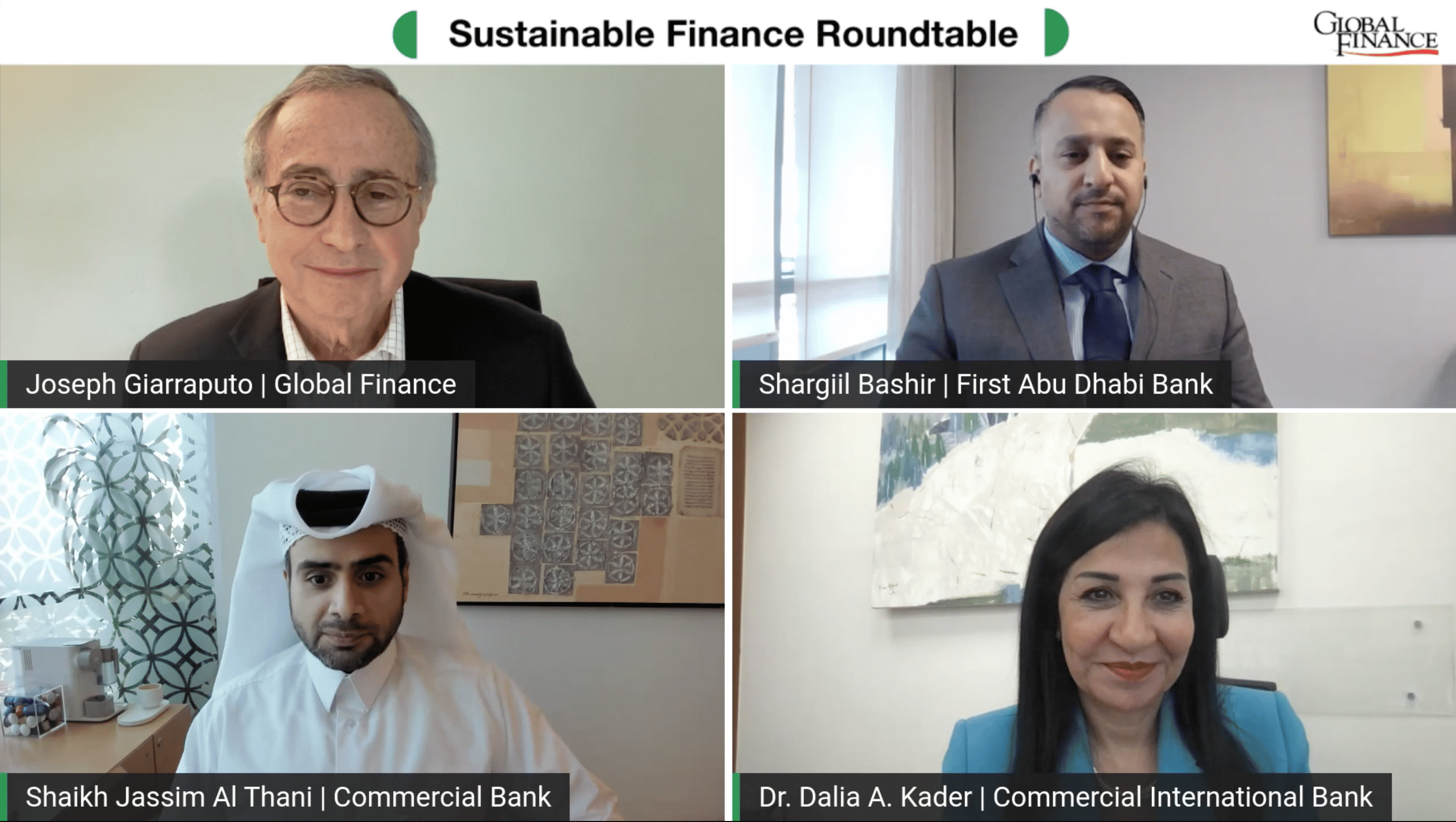

As the MENA region prepares to host the world’s major climate-change policy event, COP27, Global Finance explored the region’s sustainability commitment and sustainable finance initiatives in a discussion with experts from MENA’s leading banks.

Global Finance: How do banks in fossil-fuel reliant economies promote environmental sustainability and sustainable finance?

Shargiil Bashir: First, climate change is real, and we must all work together to address the environmental challenges ahead. Many countries with fossil-fuel driven economies are committed to net-zero carbon, and banks in these countries are working to decarbonize economies in alignment with their countries’ future net-zero goals.

Sustainable financing helps businesses transition towards decarbonization. First Abu Dhabi Bank is fully committed to supporting this transition. UAE was among the first countries in the GCC committing to net-zero, and FAB is among the region’s largest banks to make this commitment. Over the past five years, we facilitated over $40 billion in sustainable projects. We set a target to facilitate an additional $75 billion in sustainable projects by 2030.

Companies in the hydrocarbon industry must also be part of the long-term solution. We cannot just stop oil and gas consumption. Fossil fuel companies need to support the transition to renewables over the next 10 to 20 years.

Global Finance: What sustainable finance or ESG product offerings have you brought to market?

Dr. Dalia Kader: CIB has been engaged in sustainable finance since 2015, but our $100 million green bond issued in 2020–the first in Egypt–is a landmark product. The Green Bond has been quite successful, and has brought to the Egyptian market five climate mitigation projects focused on renewable energy, energy efficiency, green building, innovation and infrastructure, and climate action.

Issuing our green bond further drove bank’s the ESG architecture; as a case in point the Bank issued its Green Bond Framework, following the ICMA and Financial Regulatory Authority mandates and integrating risk, corporate and banking departments. The Bank went even further beyond meeting the green bond requirements. We made a fundamental change in our infrastructure enabling us to develop a plethora of sustainable finance products, like energy efficiency green building and transportation renewables.

Subsequently, we launched a sustaining sector platform to provide clients access to our whole sustainable ecosystem–products, education, certification–and help them understand the business aspect of sustainability. No matter how robust or agile a bank becomes, unless your ecosystem is synchronized, it will not be completely sustainable.

There was initial concern that our ESG system could intimidate clients. On the contrary, our risk officers pointed out opportunities to improve client operations, such as environmental screenings for transactions that identify gaps in the client’s operational cycle and ways to be more more resource efficient, thus enabling them to save operational expense, de-carbonize and have broader access to global markets.

Bashir: To reach sustainability or net-zero targets, the financial industry must focus on products that are relevant to customers.

FAB introduced our ESG strategy last year, and we take products our customers use–credit cards, current accounts, car loans–and make them sustainable financing products. We introduced green car loans specifically for customers purchasing electric vehicles. Last month, we introduced corporate sustainable savings accounts that allocate funds only to sustainable projects. We also introduced an early green repurchasing agreement between banks.

Sustainability needs to be part of day-to-day business at the bank or with customers or other stakeholders.

Global Finance: How can human capital be marshalled to support sustainability?

Jassim Al Thani: Sustainability is about changing culture. Sustainability agendas are implemented by people, so we need a culture shift to increase knowledge about sustainability and what it takes to achieve a sustainable economy and future. This shift is about individuals understanding their impact and approach toward sustainability for themselves and for generations to come.

We foster human capital by respecting people and delivering better products for clients. One example is paying people on time, efficiently, with wages that value their services. In Qatar, we applied a debit PCS system governing wage payments for various professions, including household workers.

Banks need to create that culture where everybody understands sustainability–internally, our clients and other partners–and everyone in the organization is a sustainability ambassador. Sustainability shouldn’t be something you do at work that doesn’t matter at home. Sustainability needs to become part of our day-to-day lives to succeed.

Are we there yet? No, we have some way to go. But we’re moving very fast, and it is extremely important that we continue taking big steps in that direction.

Dr. Kader: Currently, there is a rising focus on carbon emissions and climate, yet there is a social dimension with climate justice and financial inclusion. But it’s not just humans; it’s the whole ecology. Banks can’t just focus on the E or the S in ESG. It is important for banks to manage their impact on impact on climate change as well as biodiversity and ecology.

Global Finance: Where does your bank stand on net-zero commitments and principles for responsible banking?

Dr. Kader: CIB is a founding signatory to the UNEPFI Principles for Responsible Banking in 2019. These principles redefine the role of banks, evolving our function from just funding to funding with sensitivity to environmental, social and governance connections.

Sustainable finance first appeared as a concept in the mid-1990s. But its implementation was not diligently pursued . Banks were making a profit. The 2008 Global Financial Crisis urged the banks to realize it’s time to evolve.

Principles for Responsible Banking provide a framework for understanding our new role and operating responsibly. The six Principles for Responsible Banking are alignment, impact & target setting, customers, stakeholders, governance and transparency. The first four signify banks’ capacity to address stakeholders. Alignment is very important for bank’s to sustain growth because it means you are strategically connected to industry trends–agile, not static. Knowing how to be profitable 10 years ago does not guarantee you can sustain profitability into the future.

Impact assessment is another significant principle. Banks screen into their lending and investment portfolios to identify positive impacts to further increase and negative impacts to mitigate. Impact assessment is important in as far as it enables banks to d-carbonize their portfolios. Understanding impact is also important for risk management.

Furthermore, CIB became a founding signatory of the Net-Zero Banking Alliance in 2021 and currently represent Africa on the Steering Committee. We committed to net-zero by 2050, with interim reporting by 2030. The Bank saw the business case for de-carbonizing our portfolio in sync with your values, investing in growing sectors, like energy efficiency, renewable building, green transportation, at the same time we limit our exposure to high polluting sectors that are gradually fading out.

The business case for banks to join frameworks like the PRB and Net-Zero Banking Alliance mainly lies in enabling banks to assess environmental-social risk. This is not an easy target and requires governance commitment. There is room for more banks to join, and I appreciate FAD joining in.

Bashir: I agree it’s extremely important that banks use these frameworks actively. FAB joined the Net-Zero Banking Alliance last year. As a leading bank in our country, and the region, we support this initiative, which gives the framework for making the transition to net zero. It also provides opportunities to help your clients make this transition.

Banks must change to address clients’ future needs. It’s not only about reducing exposure. It’s about moving into future opportunities decarbonization will create. Banks have a vital role providing capital for the future.

To be a bank of choice in the future, consider what kind of organization you want to be for clients. All our stakeholders are focused on sustainability. Investors require more ESG-focused assets and our clients internationally are now willing to pay higher prices for sustainable products. Our employees are a new generation that wants to work for organizations with clear visions on sustainability. Regulators locally, regionally and internationally are more focused on sustainability, in terms of both risk and opportunity, and they want banks to play an important role.

More banks globally need to make sustainability commitments because that is what is required.

Dr. Kader: In the Emirates, Saudi Arabia, Jordan, Morocco, Egypt, we are witnessing very progressive regulations from central banks and federations. For example, Central Bank of Egypt issued in July 2021 comprehensive, progressive sustainable finance guidelines, mentioning frameworks like Principles for Responsible Banking, TCFD, and GRI, encouraging financial institutions to follow suit.

Global Finance: This year, the MENA region will host two premiere global events–COP27 and the World Cup. How will they move sustainability forward?

Al Thani: Qatar is the first Arab country to host the World Cup. We are committed to delivering a carbon-neutral event in its construction, transportation and by continuing the event into the future. It will demonstrate that the region is energy forward and bring the world together as one society learning to practice sustainability in real life.

Bashir: Holding COP27 in Egypt, then COP28 in Abu Dhabi in 2023–two consecutive COPs in the MENA region–shows this region’s importance to climate change from an energy perspective. At these events, global decisions are made about the future of sustainability and decarbonization. Egypt is well-placed in taking up the climate discussion and the government and private sector are focused on COP27.

One of the main outcomes of COP26 was the private sector really got involved. Alliance and collaboration are required between the public and private sectors to make policy but input from the private sector is how we achieve climate goals. Both Egypt and UAE will showcase how difficult decisions can be taken to move from commitments to concrete actions.

Dr. Kader: Agreed that the high point of COP 26 was private sector engagement and the establishment of the Glasgow Financial Alliance for the Net Zero (GFANZ), and introduction of the International Sustainability Standards Board, establishing non-financial reporting. Otherwise, there was incremental progress represented in several climate initiatives that nonetheless fell short of meeting the expectations to achieve the 1.5-degree challenge.

COP27 has the potential to steer the way to mobilize international funds towards mitigation and adaptation projects. The Supply side is established: there are funds, including the GFANZ $130 trillion in assets ready to be applied to sustainable investments as mandated by the European Union Green Deal. The demand side is under-developed and needs to be further structured. Banks in the MENA should collaborate to develop a pipeline of bankable and investible climate adoption projects and introduce robust ESG data disclosure.

If we focus on that, COP27 and 28 will result in on ground implementation of flow of funds, addressing starvation, drought, and renewable energy, saving continents and saving lives.

Bashir: My wish list for COP27 is that we get more action to support the ambitions we all have now. We also need more alignment. We see regulation coming but we are not working in alignment.

Right now, more than 25 different sustainability taxonomies are being developed for different countries. That will not be beneficial for anyone. Financial institutions need to come into alignment with a common understanding of what is classified as sustainable, so we don’t have situations where something is accepted as green finance in one country but not in another. Corporates also don’t want to have products accepted as sustainable in one country but not in another. We need more alignment on regulation as well. At the end of the day, this will make a big difference in simplifying what people can do to achieve sustainability targets.

Al Thani: One of the UN Global Compact’s sustainability principles is that we are accountable and responsible as banks, corporates, and companies for sustainability throughout the entire supply chain.

Each of us operates as part of a larger ethical chain. Banks have a responsibility to lead, driving positivity towards the environment and a sustainable future. This is not one-sided. We are really uplifting society, too, with a more responsible approach to the economy and lives in general.

Shargiil Bashir is the Chief Sustainability Officer at First Abu Dhabi Bank (FAB), responsible for developing, leading, and implementing the bank’s ESG strategy and initiatives. He was among the main drivers of the bank joining the UN-convened Net Zero Banking Alliance as the first bank in UAE and GCC. He is a seasoned banker with more than 20 years of experience, and led various aspects of Corporate Governance, Strategy, Risk Management, Risk Assurance and Sustainability across multiple countries. Prior to joining FAB in November 2020, Shargiil was the group head of Risk Quality Assurance at Danske Bank, based in Denmark. Shargiil holds a B.A. in Business Administration and an Executive MBA from Copenhagen Business School, Denmark, and has completed Executive Education with INSEAD.

Dr. Dalia A.Kader is currently chief sustainability officer of Commercial International Bank, Egypt’s largest private-sector bank, and chair of the Sustainable Finance Committee at the Federation of Egyptian Banks. In addition, she is founder, vice chairman and a board member of the We Owe it to Egypt Foundation and a board member of the CIB Foundation. She is also a member of the UNEP FI Banking Board “Principles for Responsible Banking” representing the MENA region and the Net Zero Banking Alliance (NZBA) Steering Committee representing Africa. Dr. Kader earned a B.A. from the American University in Cairo in 1984 (major in Political Science & minor in Economics), an M.A. in Political Science from the American University in Cairo in 1989, and a Ph.D. in Political Science from Cairo University in 2003.

Jassim Saud Al Thani joined the Commercial Bank of Qatar in 2018 from North Oil Company, where he was heading Public Relations and Communications. He holds a specialized master’s degree in Strategic Business Unit Management from HEC Paris and a bachelor’s degree in Computer Science Engineering from University of Qatar. He has extensive experience leading Global HR functions, including management of HR operations and Nationalization in Maersk Oil Qatar and a global HRBP with major business units in Maersk Oil in Denmark.

The Roundtable can be viewed below: